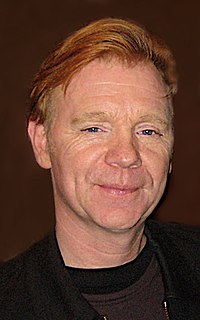

A Quote by Tim Harford

I think the association of economics with forecasting is unfortunate and is down to the fact that one great way to get an investment bank's name on business television is to hire a guy called a Chief Economist who will go and prognosticate.

Related Quotes

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

I think that intelligent forecasting (company revenues, earnings, etc.) should not seek to predict what will in fact happen in the future. Its purpose ought to be to illuminate the road, to point out obstacles and potential pitfalls and so assist management to tailor events and to bend them in a desired direction. Forecasting should be used as a device to put both problems and opportunities into perspective. It is a management tool, but it can never be a substitute for strategy, nor should it ever be used as the primary basis for portfolio investment decisions.

How should the best parts of psychology and economics interrelate in an enlightened economist's mind?... I think that these behavioral economics...or economists are probably the ones that are bending them in the correct direction. I don't think it's going to be that hard to bend economics a little to accommodate what's right in psychology.

I want to work in a bank, definitely. Hopefully, my acting career will go well. But if it doesn't, I go to a bank. If it does, then even at the age of 40, I will still go to a bank, but I have to work in a bank, because I'm really fond of taxation and accounts and investments and all of that. So I will do it. At some point, I will, yes.

I saw this new thing called television, and I saw people throwing pies in each other's faces, and I thought, 'This could be a wonderful tool for education! Why is it being used this way?' So I said to my parents, 'You know, I don't think I'll go into seminary right away. I think I'll go into television.'

Blue collar workers cannot hire each other. White collar workers cannot hire each other. You have to have a businessman or a businesswomen, a business owner to hire you. And you cannot make the environment so unfriendly to them or so unprofitable or so burdensome that they go out of business,because if they go out of business, you are out of a job.

If you go back to Adam Smith, you find the idea that markets and market forces operate as an invisible hand. This is the traditional laissez-faire market idea. But today, when economics is increasingly defined as the science of incentive, it becomes clear that the use of incentives involves quite active intervention, either by an economist or a policy maker, in using financial inducements to motivate behavior. In fact, so much though that we now almost take for granted that incentives are central to the subject of economics.

I think that it's more important for an economist to be wise and sophisticated in scientific method than it is for a physicist because with controlled laboratory experiments possible, they practically guide you; you couldn't go astray. Whereas in economics, by dogma and misunderstanding, you can go very sadly astray.