A Quote by Tim Holden

Coal research and development provides huge benefits for the nation, and pay for itself many times over through taxes flowing back to the Treasury from expanded economic activity.

Related Quotes

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

We can decide that the presence of cancer-causing substances in our air, water, and food is too expensive. A 2009 study, for example, has found that coal miners in Appalachia costs the region five times more in premature deaths, including from cancer, than it provides to the region in jobs, taxes, and economic benefits. In California, the production and use of hazardous chemicals cost the state $2.6 billion in 2004 alone in lost wages and health-care expenses to treat workers and children with pollution-linked diseases.

The theory of government I was taught says that government provides benefits, primarily security, to the entire population. In return we pay taxes. But lately the government has been a distributor of special privileges, taking money from some and giving it to others. America is now about evenly split between those who pay income taxes and those who consume them.

With more than half of the American workforce without private pension coverage, Social Security provides economic certainty within a system that is fair, equitable, and easy to understand. You work hard, pay into the system, and the federal government makes a promise to pay back your earned benefits when you retire. It's that simple.

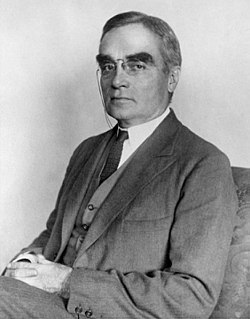

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

No matter what anyone may say about making the rich and the corporations pay the taxes, in the end they come out of the people who toil. It is your fellow workers who are ordered to work for the Government, every time an appropriation bill is passed. The people pay the expense of government, often many times over, in the increased cost of living. I want taxes to be less, that the people may have more.

The United States is the nation of innovation. And we have the best innovators, really, in the world. Our international property is one of our huge national economic assets. Yes, so to the extent that some are seeking to infiltrate our network, steal that information, not to have invest in the research and development that goes into innovation, that's a really big deal.