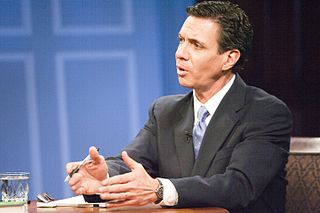

A Quote by Tim Lee

The financial system as a whole has had the characteristics of a Ponzi scheme if we look at it fundamentally.

Related Quotes

The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences.

The only reason there is a crisis about Social Security in the US and pensions in Europe and Japan is that you cannot maintain a "Ponzi" scheme indefinitely. We have collected from today's young to pay today's old and counted on tomorrow's young to keep doing so. That was a fine scheme as long as the number of young people was rising faster than old people. When that ratio comes to an end, such a system also has to end.

I know that plenty of folks have issues with Social Security, but I'd urge them to confront it on its own terms. Calling it a Ponzi scheme is misleading and does more to cloud the issue than it does to illuminate it. And yes, I do know that unless changes are made, the current system is unsustainable. But that doesn't mean it's fraud.