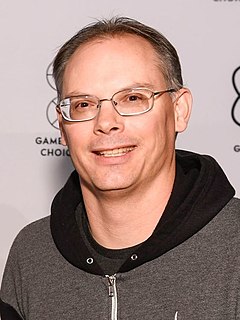

A Quote by Tim Sweeney

We all remember the tech bubble of the late '90s, but companies like Amazon survived. Wherever there's strong, enduring value, it can last through that kind of turmoil.

Related Quotes

I think it's a competitive advantage that both Amazon and Google and other tech companies have over a lot of their counterparts. They take big risks and are pioneering new markets with the promise of big rewards. It's why Amazon is kind of reliably starting new businesses and opening kind of new frontiers.