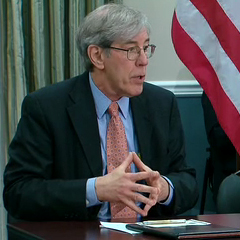

A Quote by Timothy Geithner

The substantial uncertainty about the path of asset price movements going forward necessarily reduces the case for altering policy in advance of the move.

Quote Topics

Related Quotes

Even though it is the case that poverty is linked to AIDS, in the sense that Africa is poor and they have a lot of AIDS, it's not necessarily the case that improving poverty - at least in the short run, that improving exports and improving development - it's not necessarily the case that that's going to lead to a decline in HIV prevalence.

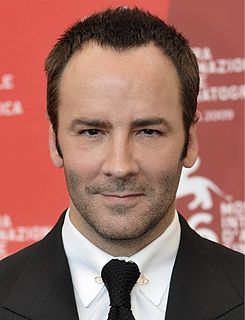

Stephen Miller is from Santa Monica. He was educated I believe at Duke. He has worked for Jeff Sessions. He's in his thirties and he's brilliant. He is literally brilliant. He is one of the - if not the - best spokesmen that the Donald Trump administration can roll out to make the case for whatever policy positions they're trying to advance. He can make the case ideologically. He can make the case in common sense.

Snowden has presented us with choices on how we want to move forward into the future. We're at a crossroads and we still don't quite know which path we're going to take. Without Snowden, just about everyone would still be in the dark about the amount of information the government is collecting. I think that Snowden has changed consciousness about the dangers of surveillance.