A Quote by Timothy J. Russert

Looking at the high cost of occupation in Iraq and the needs we have in this country, would it not have been better to have smaller tax cuts in order to keep down the deficits.

Related Quotes

His presidency ended more than a decade ago, but politicians, Democrat and Republican, still talk about Ronald Reagan. Al Gore has an ad noting that in Congress he opposed the Reagan budget cuts. He says that because Bill Bradley was one of 36 Democratic Senators who voted for the cuts. Gore doesn’t point out that Bradley also voted against the popular Reagan tax cuts and that it was the tax cuts that piled up those enormous deficits, a snowballing national debt.

Over the past 100 years, there have been three major periods of tax-rate cuts in the U.S.: the Harding-Coolidge cuts of the mid-1920s; the Kennedy cuts of the mid-1960s; and the Reagan cuts of the early 1980s. Each of these periods of tax cuts was remarkably successful as measured by virtually any public policy metric.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

The world is likely to view any temporary extension of the income tax cuts for the top two percent as a prelude to a long-term or permanent extension, and that would hurt economic recovery as well by undermining confidence that we're prepared to make a commitment today to bring down our future deficits.

Maybe that first, gigantic deficit the Reaganites piled up was an accident, just a combination of deluded 'supply side' tax cuts and a huge bag of good stuff for the Pentagon. But pretty quickly conservatives discovered that deficits, when done correctly, did something really cool: deficits defunded the Left.

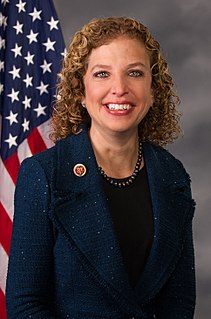

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.