A Quote by Timothy Noah

Voters care only that student loans remain freely available and that they cost taxpayers as little as possible.

Related Quotes

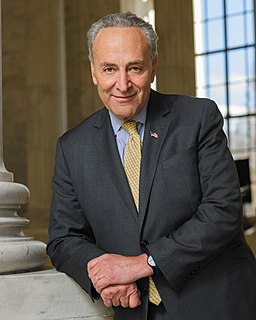

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.

Just like a house is worth whatever a bank's going to lend against it, an education is worth whatever the bank is going to lend the student to pay the university. So the availability of government-guaranteed student loans has vastly inflated the cost of education, just like it's inflated the cost of housing.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

Donald Trump and Eddie Gillespie and the Republicans in the Commonwealth of Virginia are the No. 1 impediment to Medicaid expansion. Voters understand that, and so, when they go to the polls, there's a lot of health care voters in Virginia. There's a lot of health care voters in New Jersey. And when you have a party whose belief is that health care is a privilege for a few, like the Republicans believe, that has consequences.

Little by little, the U.S. has allowed questionable domestic policies to chip away at the only hope poor students have at a better future. The Right Wing loves to distract voters from these realities by making it seem as though the poor remain so because they lack the work ethic necessary to 'pull themselves up by their bootstraps.'