A Quote by Timothy Noah

Ultimate success for a carbon tax would mean so complete a shift to renewable energy that the tax would stop raising much revenue at all.

Related Quotes

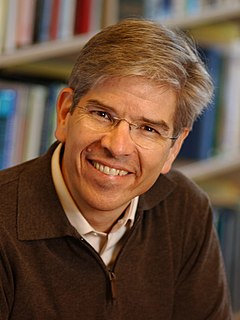

We're talking about should we increase taxes? Why not put a tax on carbon emissions. It would raise a lot of money, it would reduce the environmental damages in the future, it would solve so many problems, and it would be a much more constructive thing to do than to think about raising the income tax.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

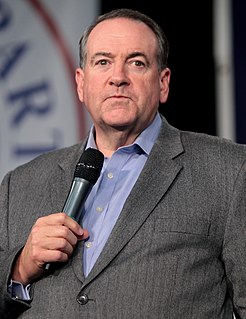

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.