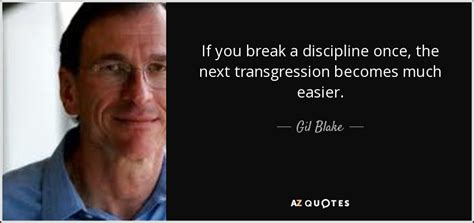

A Quote by Tom Basso

I think investment psychology is by far the more important element, followed by risk control, with the least important consideration being the question of where you buy and sell.

Related Quotes

J.P. Morgan once had a friend who was so worried about his stock holdings that he could not sleep at night. The friend asked, 'What should I do about my stocks?' Morgan replied, 'Sell down to your sleeping point' Every investor must decide the trade-off he or she is willing to make between eating well and sleeping well. High investment rewards can only be achieved at the cost of substantial risk-taking. So what is your sleeping point? Finding the answer to this question is one of the most important investment steps you must take.

One of the most important analytic tools when assessing an investment is an intellectually advantaged disparate view. This includes knowing more and perceiving the situation better than others do. It is also critical to have a keen understanding of what the market expectations for any investment truly are. Thus, the process by which a disparate perception, when correct, becomes consensus should lead to meaningful profit. Understanding market expectation is at least as important as, and often different from fundamental knowledge.

The risk of working with people you don't respect; the risk of working for a company whose values are incosistent with your own; the risk of compromising what's important; the risk of doing something that fails to express-or even contradicts--who you are. And then there is the most dangerous risk of all--the risk of spending your life not doing what you want on the bet that you can buy yourself the freedom to do it later.

There is no question that an important service is provided to investors by investment companies, investment advisors, trust departments, etc. This service revolves around the attainment of adequate diversification, the preservation of a long-term outlook, the ease of handling investment decisions and mechanics, and most importantly, the avoidance of the patently inferior investment techniques which seem to entice some individuals.

Positivity psychology is part and parcel of psychology. Being human includes both ups and downs, opportunities and challenges. Positive psychology devotes somewhat more attention to the ups and the opportunities, whereas traditional psychology - at least historically - has paid more attention to the downs.

Investing is the intersection of economics and psychology. The analysis is actually the easy part. The economics, the valuation of the business isn't that hard. The psychology - how much do you buy, do you buy it at this price, do you wait for a lower price, what do you do when it looks like the world might end - those things are harder. Knowing whether you stand there, buy more, or whether something has legitimately gone wrong and you need to sell, those are harder things. That you learn with experience, by having the right psychological makeup.