A Quote by Tom J. Donohue

One of the principal impediments to job creation is uncertainty on the part of American companies, large and small. We've all watched as companies have sat on a lot of capital. They're uncertain about what tax policy is going to be. They're clearly uncertain about how health care costs. They're uncertain about all the regulations on capital markets.

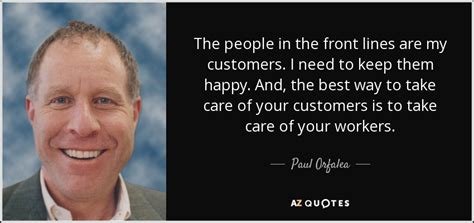

Related Quotes

The idea that you try to time purchases based on what you think business is going to do in the next year or two, I think that's the greatest mistake that investors make because it's always uncertain. People say it's a time of uncertainty. It was uncertain on September 10th, 2001, people just didn't know it. It's uncertain every single day. So take uncertainty as part of being involved in investment at all. But uncertainty can be your friend. I mean, when people are scared, they pay less for things. We try to price. We don't try to time at all.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

One of the best investors around, Joel Greenblatt, has written a popular, charming and funny book about investing in great companies at low P/E multiples. To simplify an already simple book, great companies are generally measured as companies that can generate lots of profit without requiring a lot of capital. This means that they have high ROEs.

Fancy what a game of chess would be if all the chessmen had passions and intellects, more or less small and cunning; if you were not only uncertain about your adversary's men, but a little uncertain also about your own. You would be especially likely to be beaten, if you depended arrogantly on your mathematical imagination, and regarded your passionate pieces with contempt. Yet this imaginary chess is easy compared with a game a man has to play against his fellow-men with other fellow-men for instruments.

Small and mid-sized companies in this country historically have been responsible for creating the overwhelming majority of new jobs in the private sector. One of the most-common misconceptions about our private enterprise system is that large companies, such as the Fortune 500, are integral to the process of job creation in this country. The truth is quite the opposite.

The big picture is: the main thing you should be concerned about in the future are incremental returns on capital going forward. As it turns out, past history of a good return on capital is a good proxy for this but obviously not foolproof. I think this is an area where thoughtful analysis can add value to any simple ranking/screening strategy such as the magic formula. When doing in depth analysis of companies, I care very much about long term earnings power, not necessarily so much about the volatility of that earnings power but about my certainty of "normal" earnings power over time.

I accept that life is uncertain--that the goal is not to become more certain about anything but to relax more into the mystery of not knowing what will come next. And then, miracle of miracles, out there in the deep and uncertain water, I come into a peaceful knowing--a faithful wisdom that surpasses control and certainty.