A Quote by Tom Reed

I think in 2012 one of the primary issues that will get a lot of discussion will be comprehensive tax reform.

Quote Topics

Related Quotes

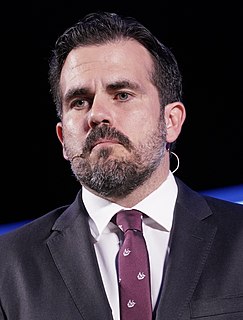

We're trying our best to develop sort of strategies. We have already turned into law a labor reform law that will allow for more opportunities to ensue. We have also established a permits law that will facilitate permits in Puerto Rico. We are about to roll out a comprehensive tax reform that will enhance the base and will reduce the rates in Puerto Rico.

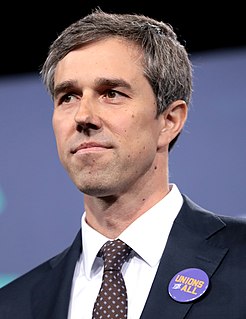

I thought for a while, Barack Obama, although he wanted comprehensive reform had less a good chance of getting it than Donald Trump because of the Nixon goes to China factor here, where Trump can secure the border and get people on board, I think he could see comprehensive reform. Not this year, but maybe next year.

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.