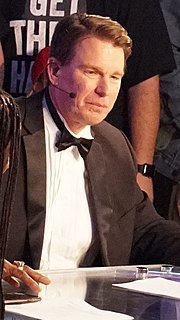

A Quote by Tommy Tuberville

We've seen it time and again - Chinese companies don't play by the rules, committing intellectual property theft and disregarding basic regulatory standards at the expense of investors. Not a single taxpayer dollar should be invested with these entities that have a clear history of corruption.

Related Quotes

I don't think any foreign Internet company can effectively compete against Chinese companies in the Chinese market. The regulatory environment is so difficult that it's almost impossible for foreigners to have an advantage over locals who have better political connections and who can manipulate the regulatory system much more effectively.

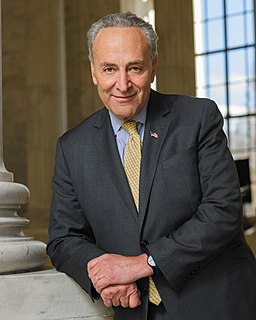

If you talk privately to our tech companies, our pharmaceutical companies, our high-end manufacturing companies, the high end of America, where the good-paying jobs are, China is not letting them in unless China gets to steal their intellectual property in a company that`s 51 percent owned by the Chinese.

The last few months have seen a welcome race to the top. Consumers have sent companies a clear signal that they do not want their purchasing habits to drive deforestation and companies are responding. Better still, companies are committing to working in partnership with suppliers, governments and NGOs to strengthen forest governance and economic incentives. It can be done and this Declaration signals a real intention to accelerate action.

One ideological claim is that private property is theft, that the natural product of the existence of property is evil, and that private ownership therefore should not exist... What those who feel this way don't realize is that property is a notion that has to do with control - that property is a system for the disposal of power. The absence of property almost always means the concentration of power in the state.