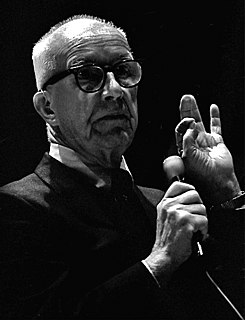

A Quote by Tony Abbott

There will be no overall increase in the tax burden whatsoever.

Quote Topics

Related Quotes

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

5: Social security will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1944: The G.I. Bill will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1965: Medicare will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1994: Health care will break small business, become a huge tax burden on our citizens, and bankrupt our country!