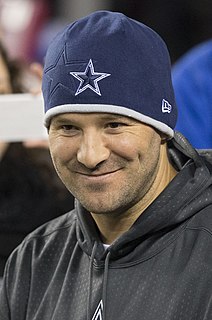

A Quote by Tony Romo

I think you use the negative things that happen from the year before - and from other years, too - to spur you to do the things you need to do to take the next step.

Related Quotes

I think people in general don't take enough risks. Some people feel that before they can take on that next challenge they need to be 100 percent ready. It's just not true. Even people in their jobs aren't perfect at their jobs. So my biggest advice to people is to step out there. Take the risk and deal with it. What is the worst that could happen? It's about thriving on risk instead of shrinking from risk.

I don't think anything ever "needs" to happen. I don't think it's more positive to have a Twitter account, a Tumblr, and a blog. Someone without those things will use their time to do other things, like read books or swim or talk to their children or read websites or listen to music or write books or lie in bed or sit in a chair. I don't think any of these things are more positive than any other things.

The essence of the this-time-is-different syndrome is...rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times; crises do not happen to us, here and now. We are doing things better, we are smarter, we have learned from past mistakes. The old rules of valuation no longer apply. Unfortunately, a highly leveraged economy can unwittingly be sitting with its back at the edge of a financial cliff for many years before chance and circumstance provoke a crisis of confidence that pushes it off.