A Quote by Toshihiko Fukui

In this context, the current recovery in the Japanese economy is taking place in tandem with the growing interdependence with the rest of the world, particularly with the other East Asian economies.

Related Quotes

Growing economies are critical; we will never be able to end poverty unless economies are growing. We also need to find ways of growing economies so that the growth creates good jobs, especially for young people, especially for women, especially for the poorest who have been excluded from the economic system.

Both in the US and throughout the world, there needs to be a growing presence of public development banks. These banks would make loans based on social welfare criteria - including advancing a full-employment, climate-stabilization agenda - as opposed to scouring the globe for the largest profit opportunities regardless of social costs.... Public development banks have always played a central role in supporting the successful economic development paths in the East Asian economies.

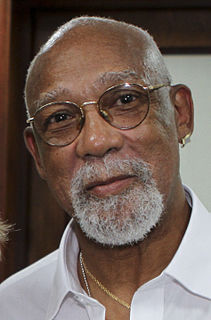

As a kid growing up and seeing so much strife taking place in society, and particularly on Blacks and people of color, I had an opportunity as a young man to witness the change that was taking place in Harlem, the exodus of white folks leaving Harlem, which I thought was a very cohesive situation. But they felt that they needed to leave.

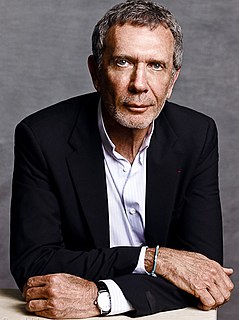

In the nearer term, the likeliest source of risk is a conflict between China and the U.S. These are now the two largest economies in the world, and the combination of their economic interdependence, the sharp differences in their political and economic values, and the growing divergence in their interests makes this relationship potentially dangerous for everyone who might be affected by it - which means pretty much everyone.

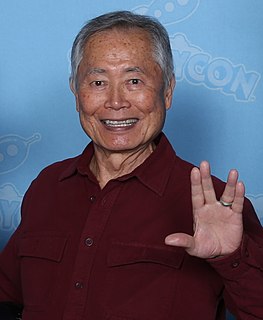

They didn't incarcerate the Japanese-Americans in Hawaii. That's the place that was bombed. But the Japanese-American population was about 45 percent of the island of Hawaii. And if they extracted those Japanese-Americans, the economy would have collapsed. But on the mainland, we were thinly spread out up and down the West Coast.