A Quote by Toshihiko Fukui

With weak balance sheets, banks tend to continue lending unprofitable businesses and leave them existing.

Related Quotes

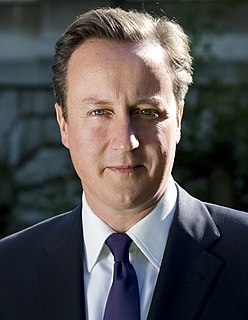

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

The problems of 2008 were never cured. The Federal Reserve's solution to the crisis was to lend the economy enough money to borrow its way out of debt. It thought that if it could subsidize banks lending homeowners enough money to buy houses from people who are defaulting, then the bank balance sheets would end up okay.

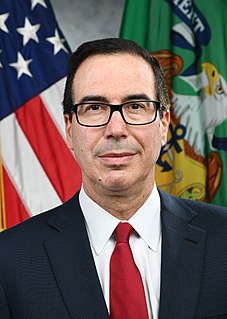

I passionately disagreed with Treasury Secretary Hank Paulson's plan to bail out the banks by using a public fund called the Troubled Asset Relief Program (TARP) to help banks take toxic assets off their balance sheets. I argued that it would be much better to put the money where the hole was and replenish the equity of the banks themselves.