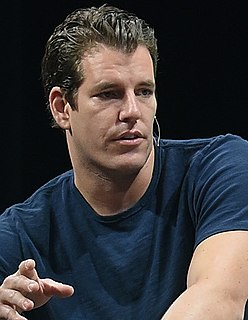

A Quote by Tyler Winklevoss

Calling bitcoin volatile - it's a non-statement. Unregulated assets with unclear regulatory landscapes are always going to be volatile. That's what unregulated assets do.

Quote Topics

Related Quotes

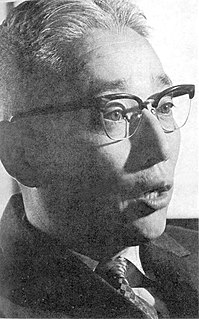

If God was the owner, I was the manager. I needed to adopt a steward's mentality toward the assets He had entrusted - not given - to me. A steward manages assets for the owner's benefit. The steward carries no sense of entitlement to the assets he manages. It's his job to find out what the owner wants done with his assets, then carry out his will.