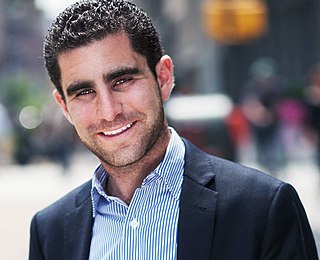

A Quote by Tyler Winklevoss

In our early experiences with bitcoin, we found how few people were building bitcoin exchanges the right way. They really weren't taking the regulation seriously; they were taking it too much like how you would approach something when you're 18, full of the excitement of youth and throwing caution to the wind.

Related Quotes

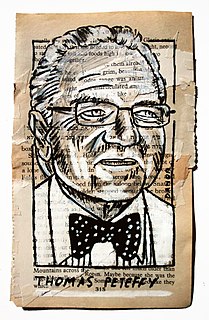

Well, bitcoin is a currency. Bitcoin has no underlying rate of return. You know, bonds have an interest coupon. Stocks have earnings and dividends. Gold has nothing, and bitcoin has nothing. There is nothing to support the bitcoin except the hope that you will sell it to somebody for more than you paid for it.