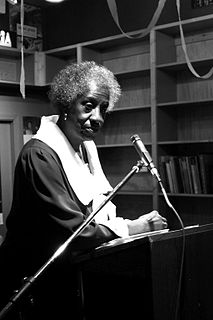

A Quote by Unita Blackwell

The big shots are not the only ones who are important. Remember, you can't sell anything on Wall Street unless someone digs it up somewhere else first.

Related Quotes

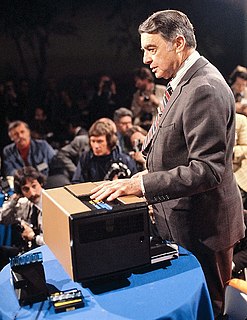

I heard governor Romney here called me an economic lightweight because I wasn't a Wall Street financier like he was. Do you really believe this country wants to elect a Wall Street financier as the president of the United States? Do you think that's the experience that we need? Someone who's going to take and look after as he did his friends on Wall Street and bail them out at the expense of Main Street America.

Tax the rich. End the wars. Break the power of lobbies in Washington. These are the demands of Occupy Wall Street. They are very important. The US corporations dominate Washington. The big oil companies, Wall Street banks and the military-industrial complex - they rule this country and their influence and power has to be broken.

As I was getting interviewed by the Wall Street Journal, or some big pub guy, all I remember was that he went off to the bathroom for a second, and they brought out my omelet. The next thing I remember, I woke up, and I was on the side of my own omelet, and there was no one at Buck's. Everyone was gone. They just let me sleep.