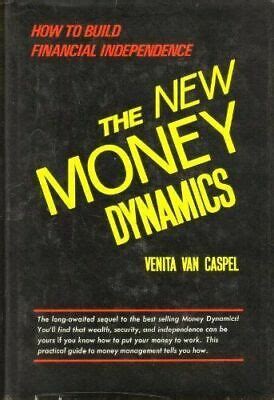

A Quote by Venita VanCaspel

One characteristic that I have observed about the timing of all good traders is that they never try to squeeze out the last point in a stock.

Related Quotes

Unfortunately, skill in evaluating the business prospects of a firm is not sufficient for successful stock trading, where the key question is whether the information about the firm is already incorporated in the price of the stock. Traders apparently lackthe skill to answer this crucial question, but they appear to be ignorant of their ignorance.

Having observed his market calls real time over the years, I can say that Jason Perl's application of the DeMark Indicators distinguishes his work from industry peers when it comes to market timing. This book demonstrates how traders can benefit from his insight, using the studies to identify the exhaustion of established trends or the onset of new ones. Whether you're fundamentally or technically inclined, Perl's DeMark Indicators is an invaluable trading resource.

There is no such thing as overnight success or easy money. If you fail, do not be discouraged; try again. When you do well, do not change your ways. Success is not just good luck: it is a combination of hard work, good credit standing, opportunity, readiness and timing. Success will not last if you do not take care of it.

"Ladies and Gentlemen, we're about to begin boarding. If we could ask for your cooperation, please stay seated until you row has been called." ... That's what they say - but somehow, by the time it comes out of the speaker, it sounds like, "Everybody up and rush the door! Everybody up and try to squeeze your big fat butts in the small gate door area! Immediately! ... Do whatever you have to do to get on board. This is the last helicopter out of Vietnam!"