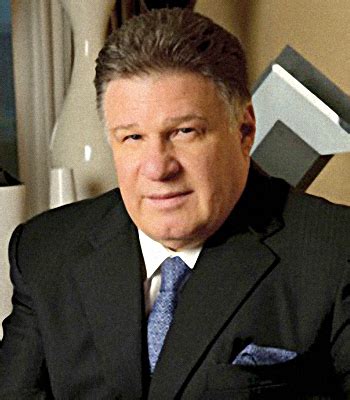

A Quote by Victor Sperandeo

Once a price move exceeds its median historical age, any method you use to analyze the market, whether it be fundamental or technical, is likely to be far more accurate. For example, if a chartist interprets a particular pattern as a top formation, but the market is only up 10% from the last low, the odds are high that the projection will be incorrect. However, if the market is up 25% to 30%, then the same type of formation should be given a great deal more weight.

Quote Topics

Related Quotes

The Heisenberg principle - If something is closely observed, the odds are it is going to be altered in the process. The more a price pattern is observed by speculators the more prone you have false signals; the more the market is a product of nonspeculative activity, the greater the significance of technical breakout

Historical romance is still very strong in the market. Writers of historical romance are making the bestselling lists on a regular basis and careers are growing. However, since there is much more variety in romance today, the total sales of historicals might be down from their peak. The talk of the market softening is a reflection of this, and of the fact that one does not see big growth in this area of the market.

Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic... There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it's the end of a bull market or the end of a bear market.

If you jump into a market when everyone else is doing the same thing, you're probably too late. On the other hand, if you get into a market early, when it's fundamentally undervalued, then wait for it to become extremely overvalued, and sell once a true top has been established, you should do very well.

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you'll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there's a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.