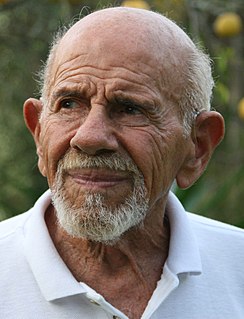

A Quote by Victor Sperandeo

The key to investment success is emotional discipline. Making money has nothing to do with intelligence. To be a successful investor, you have to be able to admit mistakes. I trained a guy to trade who had a 188 IQ. He was on "Jeopardy" once and answered every question correctly. That same person never made a dime in trading during 5 years!

Related Quotes

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliché, but the single most important reason that people lose money in the financial markets is that they don't cut their losses short.

There is a common misconception that intelligence is synonymous with IQ. "Intelligence Quotient" or IQ was originally built to predict the academic aptitude of schoolchildren, and is nothing more than a measure of the skills needed for academic success. Intelligence, however, is a much broader concept that encompasses a person's level of skill for any of a number of subjects.

Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.

Now, success is not the result of making money; making money is the result of success - and success is in direct proportion to our service. Most people have this law backwards. They believe that you're successful if you earn a lot of money. The truth is that you can only earn money after you're successful.

J.P. Morgan once had a friend who was so worried about his stock holdings that he could not sleep at night. The friend asked, 'What should I do about my stocks?' Morgan replied, 'Sell down to your sleeping point' Every investor must decide the trade-off he or she is willing to make between eating well and sleeping well. High investment rewards can only be achieved at the cost of substantial risk-taking. So what is your sleeping point? Finding the answer to this question is one of the most important investment steps you must take.

Self-discipline is the key to personal greatness. It is the magic quality that opens all doors for you, and makes everything else possible. With self-discipline, the average person can rise as far and as fast as his talents and intelligence can take him. But without self-discipline, a person with every blessing of background, education and opportunity will seldom rise above mediocrity.

Often, there is no correlation between the success of a company's operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies.

The ability to change one's mind is probably a key characteristic of the successful investor. Dogmatic and rigid personalities rarely, if ever, succeed in the markets. The markets are a dynamic process, and sustained investment success requires the ability to modify and even change strategies as markets evolve.

Successful investors tend to be unemotional, allowing the greed and fear of others to play into their hands. By having confidence in their own analysis and judgement, they respond to market forces not with blind emotion but with calculated reason. Successful investors, for example, demonstrate caution in frothy markets and steadfast conviction in panicky ones. Indeed, the very way an investor views the market and it’s price fluctuations is a key factor in his or her ultimate investment success or failure.

I think in the coming decade we will see well-conducted research demonstrating that emotional skills and competencies predict positive outcomes at home with one's family, in school, and at work. The real challenge is to show that emotional intelligence matters over-and-above psychological constructs that have been measured for decades like personality and IQ. I believe that emotional intelligence holds this promise.

We're running into a lot of new problems today because of what we emphasize in this culture. The word 'success' to the average person means earning a lot of money and having a home, two cars, children in college. Success to me is entirely different to what success is to the average person. Success is being a successful human being in terms of pursuing what you believe in. If you believe in making paintings, writing poetry, writing music. If this is what you really want, you're successful to yourself. But to be successful to your culture means to sell yourself short of what you really want

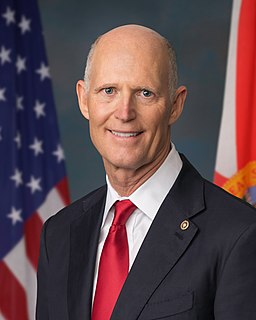

There’s no question that mistakes were made and as CEO, I have to accept responsibility for those mistakes. I was focused on lowering costs and making the hospitals more efficient. I could have had more internal and external controls. I learned hard lessons and I’ve taken that lesson and it’s helped me become a better business person and a better leader.