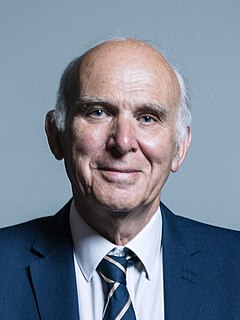

A Quote by Vince Cable

These 'masters of the universe' must be tamed in the interests of the ordinary families whose jobs and livelihoods are being put at risk. The Tories won't say anything about the current crisis as they are completely in the pockets of the hedge funds.

Related Quotes

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

I don't like writing straight-up thrillers. I like writing about families hurled into crisis and danger - soccer moms and regular dads and husbands who might have to rescue their daughters or who are, say, hedge fund managers and have one foot on the sidelines watching their kids and the other in nefarious cover-ups and conspiracies.