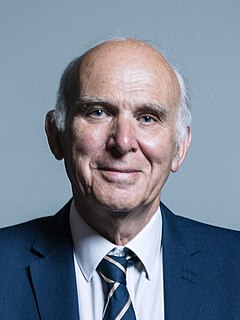

A Quote by Vince Cable

Investment banking has, in recent years, resembled a casino, and the massive scale of gambling losses has dragged down traditional business and retail lending activities as banks try to rebuild their balance sheets. This was one aspect of modern financial liberalisation that had dire consequences.

Related Quotes

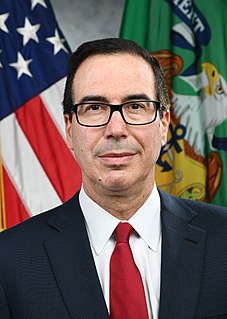

On the Glass-Steagall thing, like I said, if you could demonstrate to me that it was a mistake, I'd be glad to look at the evidence. But I can't blame [the Republicans]. This wasn't something they forced me into. I really believed that given the level of oversight of banks and their ability to have more patient capital, if you made it possible for [banks] to go into the investment banking business as continental European investment banks could always do, that it might give us a more stable source of long-term investment.

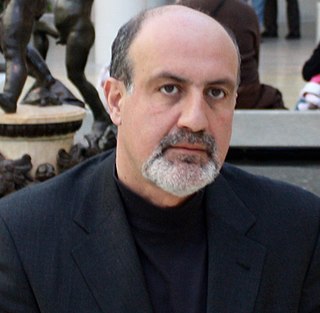

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.

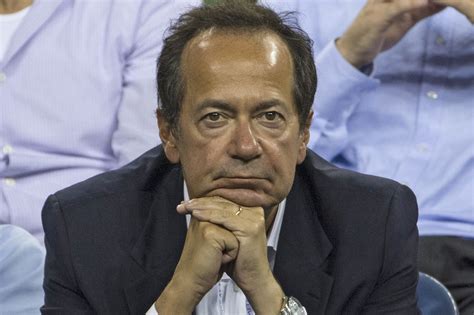

One nation banking recognises that banks must not be isolated from the rest of the economy. Because banks and small businesses must succeed or fail together, banks must lend to small businesses so we can get the growth and jobs we need for the future. As things stand, that is not happening enough. Lending was down £10.8billion last year.

We survived for hundreds of years under the old banking structure. You'd have clearing banks, then merchant banks doing the racy stuff, and then building societies where you'd join a waiting list for a mortgage. But then banks started buying stockbrokers, doing mortgages, and you ended up with these big banking groups doing everything.