A Quote by Virginia Postrel

As a general rule, durable-goods production tends to be the most volatile sector of the economy. Since people usually have a stock of durables in use, when times get tight, they put off new purchases. What seem like small cutbacks to the end buyer translate into big swings for the producer.

Related Quotes

The Stock Exchange is something very different. There is no economy and no production of goods and services. There are only fantasies in which people from one hour to the next decide that this or that company is worth so many billions, more or less. It doesn't have a thing to do with reality or with the Swedish economy.

As homeowners see the value of their homes decline, they become more likely to delay purchases of the big items - like automobiles, electronics and home appliances - that are ballasts of the American economy. When those purchases decline, large manufacturing firms, suddenly short on funds, could begin laying off employees.

If you put these five things together - you can't use money to attract talent, you can't advertise, you can't take risks, you can't invest in long-term results, and you don't have a stock market - then we have just put the humanitarian sector at the most extreme disadvantage to the for-profit sector on every level, and then we call the whole system charity, as if there is something incredibly sweet about it.

So, what people are actually left with to spend is maybe 25 to 30% of their income on goods and services, after paying taxes and after paying the FIRE sector (Finance, Insurance, Real Estate). Whether it's housing insurance or mortgage insurance. So there's an idea of distracting people. Don't think of your condition. Think of how the overall economy is doing. But don't think of the economy as an overall unit. Think of the stock market as the economy. Think of the rich people as the economy. Look at the yachts that are made. Somebody's living a lot better. Couldn't it be you?

Most people think of the economy as producing goods and services and paying labor to buy what it produces. But a growing part of the economy in every country has been the Finance, Insurance and Real Estate (FIRE) sector, which comprises the rent and interest paid to the economy's balance sheet of assets by debtors and rent payers.

Every dollar of SNAP benefits generates $1.84 in the economy in terms of economic activity. If people are able to buy a little more in the grocery store, someone has to stock it, package it, shelve it, process it, ship it. All of those are jobs. It's the most direct stimulus you can get in the economy during these tough times.

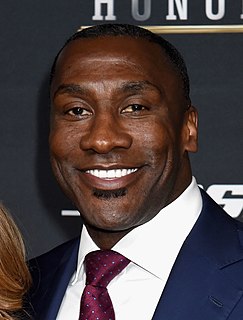

When I went to the Pro Bowl, I went as a tight end. When I made the All Pro team, I made it as a tight end. When they introduced us and I ran out of the tunnel, they introduced me as a tight end. So how is that possible that now that my career is over, they say, 'Well, he put up stats like a wide receiver?' It's not my fault I was ahead of my time.

Competition always tends to bring about the most economical and efficient method of production. Those who are most successful in this competition will acquire more capital to increase their production still further; those who are least successful will be forced out of the field. So capitalist production tends constantly to be drawn into the hands of the most efficient.

Money is not a part of the visible sector of the economy; people do not consume money. Money is not a physical factor of production, but rather a yardstick for measuring economic input, economic outtake and the relative values of the real goods and services of the economic world. Money provides a method of measuring obligations, rights, powers and privileges. It provides a means whereby certain individuals can accumulate claims against others, or against the economy as a whole, or against many economies.

Unfortunately, once an economy is geared to expansion, the means rapidly turn into an end and "the going becomes the goal." Even more unfortunately, the industries that are favored by such expansion must, to maintain their output, be devoted to goods that are readily consumable either by their nature, or because they are so shoddily fabricated that they must soon be replaced. By fashion and built-in obsolescence the economies of machine production, instead of producing leisure and durable wealth, are duly cancelled out by the mandatory consumption on an even larger scale.

I think what tends to embarrass me most is how much I struggle at the little things that seem to come so easily to most people, mainly involving routine and self-care. It's hard for me to do things like cook a meal, not be in a constant apocalyptically late rush everywhere I go, to put something back when I'm finished with it. I seem to be hardwired for chaos and disorganization.

Slow food, free-range, no steroids, eat local, and natural winemaking are all part of a general yearning for simpler times. But the fact is that most winemakers these days, big and small, have drastically lessened the use of chemicals in the vineyard, embracing such concepts as organically grown, biodynamic, and sustainable.