A Quote by Vito Fossella

If you're a retail investor, you have set aside some of your hard-earned money for investment or to create a nest egg, for your kids or family.

Related Quotes

To me, money is a vehicle; it's a tool. I could use it as a weapon to destroy things or money can create-you can create an opportunity, you can create a charity, you can create things for your family, you can go do something for your family that nobody else would ever do. You can create educational opportunities, you can feed people overseas. And there's a tremendous leverage with money, or you can destroy people with it.

It's just wrong to work your whole life to build up a nest egg, build your own business - you pass away, and Uncle Sam can swoop in and take away nearly half of everything you've earned. Can you imagine that? Having to sell off most of your land just to keep it from the government, just to save the house.

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

My financial adviser Ric Edelman...thinks the time to start educating people about money is when they are children. He's set up a retirement plan called the RIC-E-Trust that can provide retirement security. A $5,000 one-time tax-deferred investment at birth, with an average interest rate of ten percent compounded, means that a child would have $2.4 million when he or she is 65 years old. Who needs Social Security with that kind of nest egg?

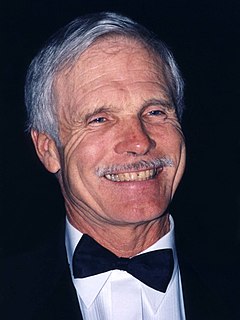

I made a lot of money. I earned a lot of money with CNN and satellite and cable television. And you can't really spend large sums of money, intelligently, on buying things. So I thought the best thing I could do was put some of that money back to work - making an investment in the future of humanity.

Ask yourself: Am I an investor, or am I a speculator? An investor is a person who owns business and holds it forever and enjoys the returns that U.S. businesses, and to some extent global businesses, have earned since the beginning of time. Speculation is betting on price. Speculation has no place in the portfolio or the kit of the typical investor.