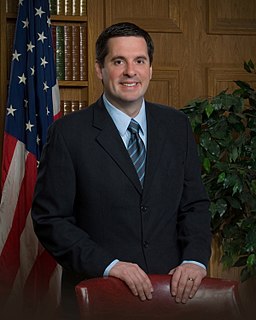

A Quote by Walker Stapleton

There is a valid nationwide sentiment of concern over public pensions, and poor funding ratios are viewed negatively by financial markets.

Related Quotes

My concern was first, for the black people of Mississippi, then I became concerned for black people nationwide, now my concern is for black people all over the world. I began to realize that it's not as much about race as we think it is. It's about the rich vs. the poor. I feel as if the different races are pitted against one another so we won't see the bigger (financial disparity) problem.

Climate change is...a gross injustice-poor people in developing countries bear over 90% of the burden-through death, disease, destitution and financial loss-yet are least responsible for creating the problem. Despite this, funding from rich countries to help the poor and vulnerable adapt to climate change is not even 1 percent of what is needed.

Financial markets are supposed to swing like a pendulum: They may fluctuate wildly in response to exogenous shocks, but eventually they are supposed to come to rest at an equilibrium point and that point is supposed to be the same irrespective of the interim fluctuations. Instead, as I told Congress, financial markets behaved more like a wrecking ball, swinging from country to country and knocking over the weaker ones. It is difficult to escape the conclusion that the international financial system itself constituted the main ingredient in the meltdown process.

It ought to concern every person, because it is a debasement of our common humanity. It ought to concern every community, because it tears at our social fabric. It ought to concern every business, because it distorts markets. It ought to concern every nation, because it endangers public health and fuels violence and organized crime. I’m talking about the injustice, the outrage, of human trafficking, which must be called by its true name - modern slavery.

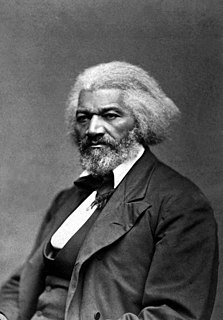

The effort to make financial or political profit out of the destruction of character can only result in public calamity. Gross and reckless assaults on character, whether on the stump or in newspaper, magazine, or book, create a morbid and vicious public sentiment, and at the same time act as a profound deterrent to able men of normal sensitiveness and tend to prevent them from entering the public service at any price.