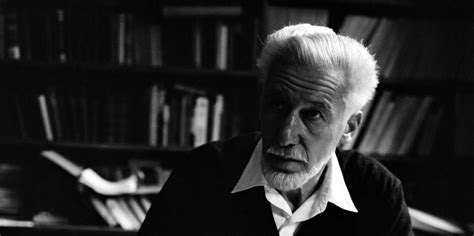

A Quote by Walter E. Williams

Three-fifths to two-thirds of the federal budget consists of taking property from one American and giving it to another. Were a private person to do the same thing, we'd call it theft. When government does it, we euphemistically call it income redistribution, but that's exactly what thieves do - redistribute income. Income redistribution not only betrays the founders' vision, it's a sin in the eyes of God.

Related Quotes

Notwithstanding what some regard as the institutionalization of compassion, the transfer society quashes genuine virtue. Redistribution of income by means of government coercion is a form of theft. Its supporters attempt to disguise its essential character by claiming that democratic procedures give it legitimacy, but this justification is specious. Theft is theft, whether it be carried out by one thief or by a hundred million thieves acting in concert. And it is impossible to found a good society on the institutionalization of theft.

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

The evolution of government from its medieval, Mafia-like character to that embodying modern legal institutions and instruments is a major part of the history of freedom. It is a part that tends to be obscured or ignored because of the myopic vision of many economists, who persist in modeling government as nothing more than a gigantic form of theft and income redistribution.

The Founding Fathers realized that "the power to tax is the power to destroy," which is why they did not give the Federal government the power to impose an income tax. Needless to say, the Founders would be horrified to know that Americans today give more than a third of their income to the Federal government.

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

If we stuck to the Constitution as written, we would have: no federal meddling in our schools; no Federal Reserve; no U.S. membership in the UN; no gun control; and no foreign aid. We would have no welfare for big corporations, or the "poor"; no American troops in 100 foreign countries; no NAFTA, GAT, or "fast-track"; no arrogant federal judges usurping states rights; no attacks on private property; no income tax. We could get rid of most of the agencies, and most of the budget. The government would be small, frugal, and limited.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.