A Quote by Walter E. Williams

It was not until the Abraham Lincoln administration that an income tax was imposed on Americans. Its stated purpose was to finance the war, but it took until 1872 for it to be repealed. During the Grover Cleveland administration, Congress enacted the Income Tax Act of 1894. The U.S. Supreme Court ruled it unconstitutional in 1895. It took the Sixteenth Amendment (1913) to make permanent what the Framers feared -- today's income tax.

Related Quotes

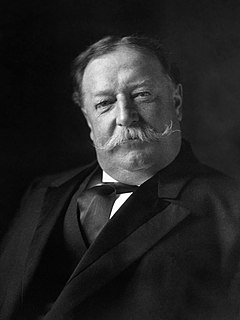

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

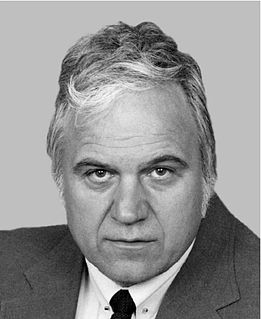

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

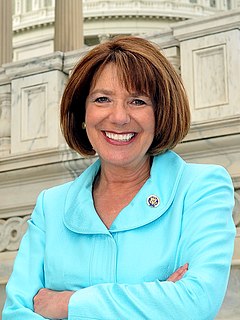

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

The final and best means of strengthening demand among consumers and business is to reduce the burden on private income and the deterrence to private initiative which are imposed by our present tax system, and this administration pledged itself last summer to an across-the-board, top-to-bottom cut in personal and corporate income taxes to be enacted and become effective in 1963.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

There are 11 states in the United States that in the last 50 years instituted an income tax. So I looked at each of those 11 states over the last 50 years, and I took their current economic metrics and their metrics for the five years before they put in the progressive income tax... Every single state that introduced a progressive income tax has declined as an overall share of the U.S. economy.

There is the general belief that the corporation income tax is a tax on the "rich" and on the "fat cats." But with pension funds owning 30% of American large business-and soon to own 50%-the corporation income tax, in effect, eases the load on those in top income brackets and penalizes the beneficiaries of pension funds.

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.