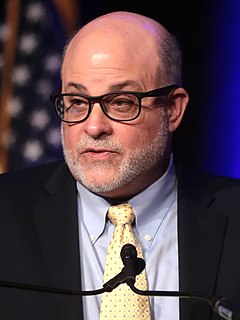

A Quote by Walter E. Williams

All we have to do now is to inform the public that the payment of social security taxes is voluntary and watch the mass exodus.

Related Quotes

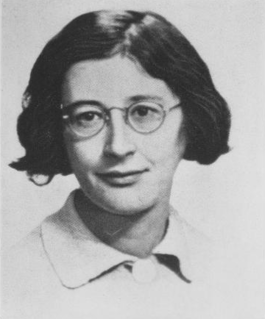

This is what class warfare looks like: The Business Roundtable - representing Goldman Sachs, Bank of America, JP Morgan Chase and others - has called on Congress to raise the eligibility age of Social Security and Medicare to 70, cut Social Security and veterans' COLAs, raise taxes on working families and cut taxes for the largest corporations in America.