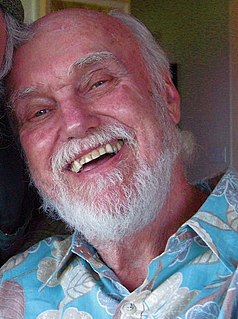

A Quote by Walter Mischel

And you can save more money for retirement. It’s not just about marshmallows.

Quote Topics

Related Quotes

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.

You know, money will never save anyone. Compassion can save someone, love can save someone, money will never save anyone. And as long as the entire society will put money first... Money should be like third or fourth or fifth, I'm not saying lets get rid of money, but how can we put money as number one? As the only value, like if you are rich, you're famous you go VIP, why? It's just insane, the way we've transformed the society.

There are two things that you need to save for. First, you need an emergency cushion of no fewer than six months of living expenses. This needs to be cash in a liquid account where you can get at it in - yes - an emergency if you need it. In other words, money markets, not CDs. You also need to save for your future: that means retirement.

Everybody's got money for vacation time. Look at how much we all spend just to get - well, I get sick on the loop-the-loop roller coasters. People pay money for that kind of experience. So I would certainly save up money, save several vacations worth of money, to go on a suborbital flight or any rocket flights.

With money we really fool ourselves. We are our biggest enemies with money and there are some things we can do about it. Automatic deductions are a wonderful thing. But ideally, you should wait until the end of the month, you can see how much extra money you had, and you should put that in your savings account. We don't do that too well, and if we did that, we would never save. So, what we do, is we take money out of our pocket into the saving account at the beginning of the month, take it outside of our control and as a consequence, we spend less and we save more.

My experience may be different than theirs, readers can identify with trying to save for retirement or their own kid's college fund. In truth, the name of the column, "The Color of Money," has less to do with my race than the fact that the color of money is green and it's green we all need to live a good life.

By working toward a financial objective, you'll start to see the money add up for retirement or the credit card balance go down. But it doesn't have an immediate impact on your day-to-day life, and when it does - like when you're pinching pennies to save more - the immediate impact could feel negative.

The issue of the pension gap has got to become visible and important to millions of people before Washington will respond seriously. Right now, everyone thinks it's his or her own problem and that individuals have to do better and save more. Of course, that is true. We all have to save more and take responsibility for our own retirement. But we have a huge social and economic problem on our hands.

The player option allows me to, hopefully, sign a lucrative deal in my prime, before retirement. If you're in a situation where you've played to a level where you can make more money, then you opt out and you make more money. And if you play really poorly, then you opt in and take the money that's scheduled to be on that piece of paper.