A Quote by Walter Russell Mead

The historian assesses that the investment of the wealthy classes in the Bank of England wedded them to the fate of the nation as a whole and to the maintenance of its stability.

Related Quotes

In a global marketplace with its increased insecurities and - indeed often - volatility and instability, national economic stability is at a premium, the precondition for all we can achieve, and no nation can secure the high levels of sustainable investment it needs without both monetary and fiscal stability together.

Can we say that the constitutional monarchies in Spain, Belgium or England are democratic? Those with superior chambers like the House of Lords in England, that still represent the English feudal nobility in terms of positions above regional representatives, who are in the end the representatives supposedly elected by the population. Many mechanisms exist, but they are mechanisms to preserve the power of the wealthy classes, of the bourgeois classes that hold the power and rights above the rest of the society.

As a matter of fact 25% of our U.S. investment banking business comes out of our commercial bank. So it's a competitive advantage for both the investment bank - which gets a huge volume of business - and the commercial bank because the commercial bank can walk into a company and say, "Oh, if you need X, Y and Z in Japan or China, we can do that for you."

This is one way that wealthy Americans could really contribute. They could put hundreds of millions of dollars into the infrastructure bank, be a good investment for them, for their children, for their grandchildren, and they would directly contribute to revitalizing a big sector of middle-class wages in America and making our country more productive, so that we could create more opportunity. But I think that we could get a lot of grassroots support from, like, local chambers of commerce and other things if they understood exactly how this infrastructure bank would work.

The States is run by the Federal Reserve, an institution that answers only to itself and to a few large banks. It's modelled on the Bank of England. Ben Franklin said that one of the main reasons America revolted was to get away from the Bank of England, the mother of all central banks - the most pernicious and insidious of all.

Ecology's implications for capitalism are too momentous for the capitalist to contemplate. The plutocrats are more wedded to their wealth than to the Earth upon which they live, more concerned with the fate of their fortunes than with the fate of humanity. The present ecological crisis has been created by the few at the expense of the many.

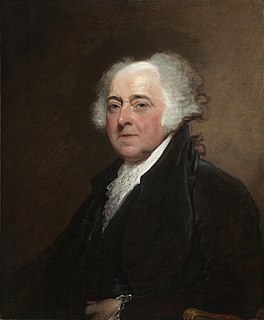

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.