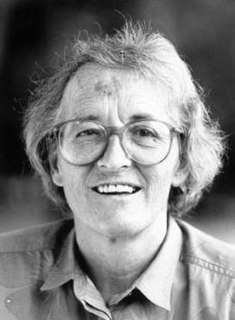

A Quote by Walter Schloss

Fear and greed are probably the worst emotions to have in connection with the purchase and sale of stocks.

Related Quotes

There are only two emotions: love and fear. All positive emotions come from love, all negative emotions from fear. From love flows happiness, contentment, peace, and joy. From fear comes anger, hate, anxiety and guilt. It's true that there are only two primary emotions, love and fear. But it's more accurate to say that there is only love or fear, for we cannot feel these two emotions together, at exactly the same time. They're opposites. If we're in fear, we are not in a place of love. When we're in a place of love, we cannot be in a place of fear.

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

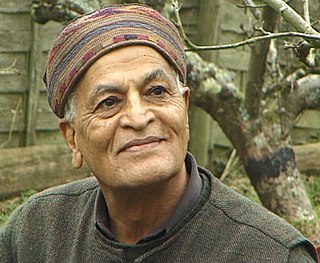

Mentally, physically and emotionally we are the same.

We each have the potential to good and bad and to be overcome by disturbing emotions such as anger, fear, hatred, suspicion and greed. These emotions can be the cause of many problems.

On the other hand if you cultivate loving kindness, compassion and concern for others, there will be no room for anger, hatred and jealousy.

But in the financial markets, without proper institutional rules, there's the law of the jungle - because there's greed! There's nothing wrong with greed, per se. It's not that people are more greedy now than they were 20 years ago. But greed has to be tempered, first, by fear of losses. So if you bail people out, there's less fear. And second, b prudential regulation and supervision to avoid certain excesses.

Connection is why we're here; it is what gives purpose and meaning to our lives. The power that connection holds in our lives was confirmed when the main concern about connection emerged as the fear of disconnection; the fear that something we have done or failed to do, something about who we are or where we come from, has made us unlovable and unworthy of connection.