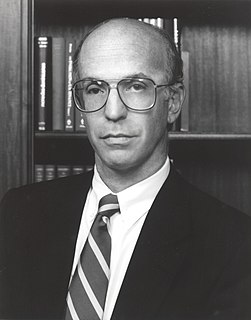

A Quote by Walter Schloss

When I buy a stock, I have kind of an idea where I want to sell it.

Related Quotes

Allowing short selling is allowing people to sell - instead of having to buy the stock and then sell it, which doesn't do much; allow them to sell it, and then buy it. In which case they can express that information and the idea is that you would get more accurate valuation of companies by letting people express both their positive information and their negative information through either long or short selling.

I sell ideas. Actually, if you think about it, everything is really no more than idea. The past is nothing more than a memory, which is one kind of idea. The future is still a hope, another kind of idea. The present is fleeting and becomes a memory before you can put your hands on it. All ideas. I sell ideas.