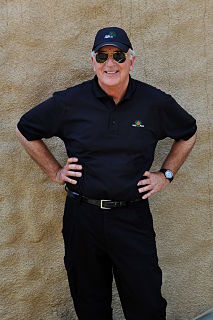

A Quote by Walter Schloss

My job was to find stocks that were undervalued.

Quote Topics

Related Quotes

Our job in this lifetime is not to shape ourselves into some ideal we imagine we ought to be, but to find out who we already are and become it.

If we were born to paint, it’s our job to become a painter.

If we were born to raise and nurture children, it’s our job to become a mother.

If we were born to overthrow the order of ignorance and injustice of the world, it’s our job to realize it and get down to business.

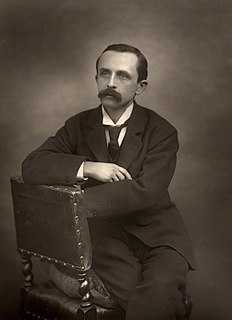

Mr. Darling used to boast to Wendy that her mother not only loved him but respected him. He was one of those deep ones who know about stocks and shares. Of course no one really knows, but he quite seemed to know, and he often said stocks were up and shares were down in a way that would have made any woman respect him.

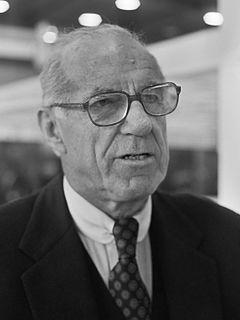

The good thing about the dividend-paying stocks is, first of all you have stocks, which are real assets if we have some inflation. I think we're going to have 2%, 3% maybe 4%. That's a sweet spot for stocks. Corporations do well with that. It gives them pricing power. Their assets move up with prices. I'm not fearful of that inflation.