A Quote by Warren Buffett

Look for companies with high profit margins.

Related Quotes

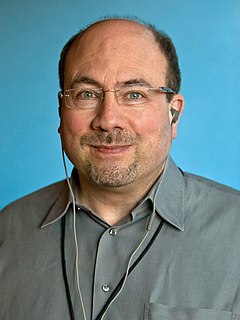

My understanding from talking to a lot of people in the business has been that it used to be that a newspaper was considered a community service. Now they're being run as profit centers, and they're trying to get pretty high profit margins. As a result, investigative reporting has been seen as a problem.

Today's consumers are eager to become loyal fans of companies that respect purposeful capitalism. They are not opposed to companies making a profit; indeed, they may even be investors in these companies - but at the core, they want more empathic, enlightened corporations that seek a balance between profit and purpose.

One of the best investors around, Joel Greenblatt, has written a popular, charming and funny book about investing in great companies at low P/E multiples. To simplify an already simple book, great companies are generally measured as companies that can generate lots of profit without requiring a lot of capital. This means that they have high ROEs.

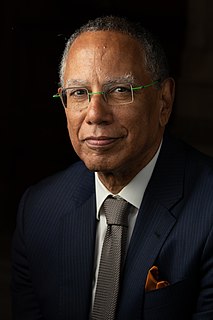

I also don't think all of the revenue will come from digital subscriptions. We have in the New York Times a mix of revenue sources and it will continue to be a mix for quite a while. What makes me more nervous is that we built this newsroom on a really high profit margin that has eroded significantly over the last years. I'm nervous that we won't continue to have the profit margins that allow us to have a big, robust newsroom.