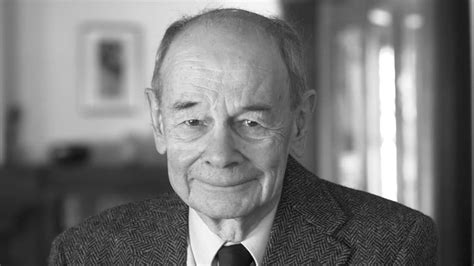

A Quote by Warren Buffett

Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.

Quote Topics

Related Quotes

A pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street (a community in which quality control is not prized) will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.

Most investors are pretty smart. Yet most investors also remain heavily invested in actively managed stock funds. This is puzzling. The temptation, of course, is to dismiss these folks as ignorant fools. But I suspect these folks know the odds are stacked against them, and yet they are more than happy to take their chances.

On the New York Stock Exchange, all buy and sell orders are routed through a single 'specialist,' guaranteeing that most small trades can be matched directly. But most larger trades are delivered to the specialist on the floor of the exchange by human brokers, a system that big investors view as increasingly inefficient.

You must have the discipline and temperament to resist your impulses. Human beings have precisely the wrong instincts when it comes to the markets. If you recognise this, you can resist the urge to buy into a rally and sell into a decline. It’s also helpful to remember the power of compounding. You don’t need to stretch for returns to grow your capital over the course of your life.