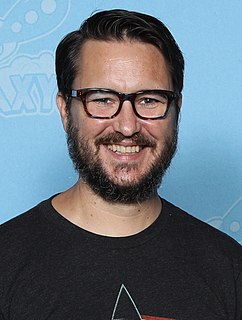

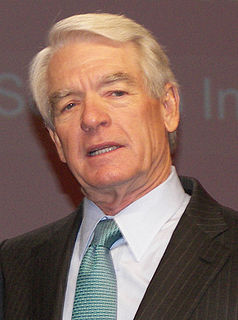

A Quote by Warren Buffett

A prediction about the direction of the stock market tells you nothing about where stocks are headed, but a whole lot about the person doing the predicting.

Quote Topics

Related Quotes

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.

[In picking stocks] You really have to know a lot about business. You have to know a lot about competitive advantage. You have to know a lot about the maintainability of competitive advantage. You have to have a mind that quantifies things in terms of value. And you have to be able to compare those values with other values available in the stock market.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

The model I like to sort of simplify the notion of what goes on in a market for common stocks is the pari-mutuel system at the racetrack. If you stop to think about it, a pari-mutuel system is a market. Everybody goes there and bets and the odds change based on what's bet. That's what happens in the stock market.

It's got to be the best intellectual exercise out there. You're seeing through new situations every ten minutes. In the stock market you don't base your decisions on what the market is doing, but on what you think is rational. Bridge is about weighing gain/loss ratios. You're doing calculations all the time.