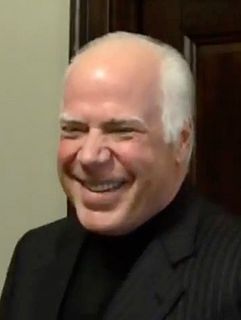

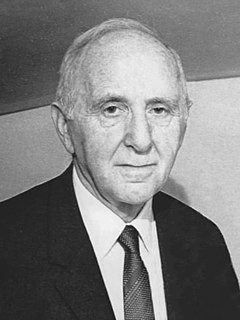

A Quote by Warren Buffett

Anyone who believes a growth rate in excess of 15% per annum over the long term is attainable should pursue a career in sales, but avoid one in mathematics.

Related Quotes

If you're going to buy something which compounds for 30 years at 15% per annum and you pay one 35% tax at the very end, the way that works out is that after taxes, you keep 13.3% per annum. In contrast, if you bought the same investment, but had to pay taxes every year of 35% out of the 15% that you earned, then your return would be 15% minus 35% of 15%-or only 9.75% per year compounded. So the difference there is over 3.5%. And what 3.5% does to the numbers over long holding periods like 30 years is truly eye-opening.

After careful consideration, we have decided that for our next fiscal year, we'll issue guidance on comparable store used unit sales and on earnings per share only for the full fiscal year. We will no longer issue quarterly guidance. This decision reflects our continuing focus on longer-term store, sales, and earnings growth and on return on invested capital, and our recognition that the performance in shorter-term periods can be more volatile than over the longer term. As we report our quarterly results, we plan to comment on how our performance is tracking against our annual guidance.

To put it in context, the federal government was, at the beginning [of the Vancouver meeting], talking about a $15-per-tonne floor for carbon emissions. We're at $30 a tonne, so we're already double that. But our economy is growing at a faster rate - three per cent of GDP is our projected growth in British Columbia.

The growth of the American food industry will always bump up against this troublesome biological fact: Try as we might, each of us can only eat about fifteen hundred pounds of food a year. Unlike many other products - CDs, say, or shoes - there's a natural limit to how much food we each can consume without exploding. What this means for the food industry is that its natural rate of growth is somewhere around 1 percent per year - 1 percent being the annual growth rate of American population. The problem is that [the industry] won't tolerate such an anemic rate of growth.