A Quote by Warren Buffett

But 300 million Americans, their lending institutions, their government, their media, all believed that house prices were going to go up consistently. And that got billed into a $20 trillion residential home market. Lending was done based on it, and everybody did a lot of foolish things.

Related Quotes

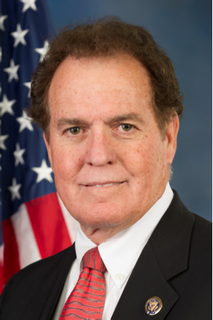

No one pushed harder than Congressman Barney Frank to force banks and other financial institutions to reduce their mortgage lending standards, in order to meet government-set goals for more home ownership. Those lower mortgage lending standards are at the heart of the increased riskiness of the mortgage market and of the collapse of Wall Street securities based on those risky mortgages.

Hudson Taylor and Charles Spurgeon believed that Romans prohibits debt altogether. However, if going into debt is always sin, it's difficult to understand why Scripture gives guidelines about lending and even encourages lending under certain circumstances. Proverbs says "the borrower is servant to the lender." It doesn't absolutely forbid debt, but it's certainly a strong warning.

Americans are fed up with how things are going in the country right now. They see more job losses, rising debt and plummeting home sales. They feel let down by a government that passes one 2,000-page, trillion-dollar law after another instead of focusing on addressing the problems Americans worry about every day.

What went wrong is we had tremendous concentration in the sense we put a lot of our money to work against U.S. real estate. We got here by lending money, and putting money to work in the U.S. real estate market, in a size that was probably larger than what we ought to have done on a diversification basis.

When I did 'Baby Got Back,' that was just a reflection of the African-American community. We've always liked curves, and a lot of people misunderstood it because let's face it: 20 years prior to 'Baby Got Back,' the only images you saw of a black woman on television were she was probably 300 pounds and cleaning the house with a rag on her head.

And people really behaved in a fraudulent way or something, we'll go back and find the culprits later on. But that really isn't the problem we have. I mean that's where it came from, though. We leveraged up and if you have a 20 percent fall in value of a $20 trillion asset, that's $4 trillion. And when $4 trillion lands - losses land in the wrong part of this economy, it can gum up the whole place.