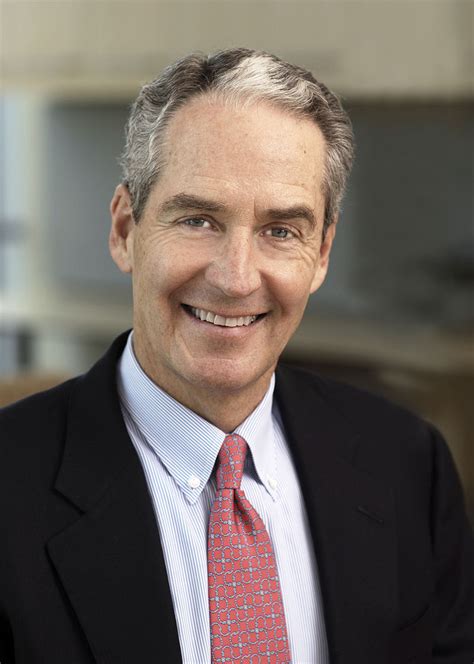

A Quote by Warren Buffett

Investment must be rational; if you can't understand it, don't do it.

Quote Topics

Related Quotes

You have to understand your own psychology. You have to understand that human beings weren't really designed to invest. We have all these emotions that are appropriate responses if you're being chased by a tiger, but they're terrible responses if you've got a 30-year time horizon to think about investment or when you're trying to manage investment over 30 years.

Unlike return, however, risk is no more quantifiable at the end of an investment that it was at its beginning. Risk simply cannot be described by a single number. Intuitively we understand that risk varies from investment to investment: a government bond is not as risky as the stock of a high-technology company. But investments do not provide information about their risks the way food packages provide nutritional data.

We are one human race, and there must be understanding among all men. For those who look at the problems of today, my big hope is that they understand. That they understand that the population is quite big enough, that they must be informed that they must have economic development, that they must have social development, and must be integrated into all parts of the world.

I want to say, and this is very important: at the end we lucked out. It was luck that prevented nuclear war. We came that close to nuclear war at the end. Rational individuals: Kennedy was rational; Khrushchev was rational; Castro was rational. Rational individuals came that close to total destruction of their societies. And that danger exists today.

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.

It's all emotion. But there's nothing wrong with emotion. When we are in love, we are not rational; we are emotional. When we are on vacation, we are not rational; we are emotional. When we are happy, we are not [rational]. In fact, in more cases than not, when we are rational, we're actually unhappy. Emotion is good; passion is good. Being into what we're into, provided that it's a healthy pursuit, it's a good thing.