A Quote by Warren Buffett

It is to our advantage to have securities do nothing price-wise for months, or perhaps years, while we are buying them.

Related Quotes

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

I once read about a meeting of economists who agreed that if their forecasts were 33 1/3 % correct, that was considered a high mark in their profession. Well, of course, I know you cannot invest in securities successfully with odds like that against you if you place dependence solely upon judgement as to the right securities to own and the right time or price to buy them. Then, too, I read somewhere about the man who described an economist as resembling ‘a professor of anatomy who was still a virgin.’

We've got the emPHAsis on the wrong sylLAble when it comes to crime in this country. The FBI says burglary and robbery cost U.S. taxpayers $3.8 billion annually. Securities fraud alone costs four times that. And securities fraud is nothing to the cost of oil spills, price-fixing, and dangerous or defective products. Fraud by health-care corporations alone costs us between $100 billion and $400 billion a year. No three-strikes-and-you're-out for these guys. Remember the S&L scandal? $500 billion.

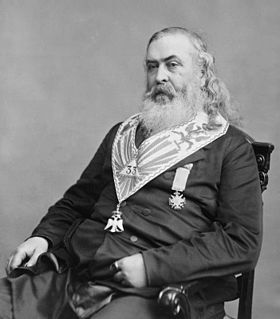

Nothing excites men's curiosity so much as Mystery, concealing things which they desire to know; and nothing so much increases curiosity as obstacles that interpose to prevent them from indulging in the gratification of their desires. Of this the Legislators and Hierophants took advantage, to attract the people to their sanctuaries, and to induce them to seek to obtain lessons from which they would perhaps have turned away with indifference if they had been pressed upon them.

He who hopes to avoid all failure and misfortune is trying to live in a fairyland; the wise man realistically accepts failures as a part of life and builds a philosophy to meet them and make the most of them. He lives on the principle of 'nothing attempted, nothing gained' and is resolved that if he fails he is going to fail while trying to succeed.