A Quote by Warren Buffett

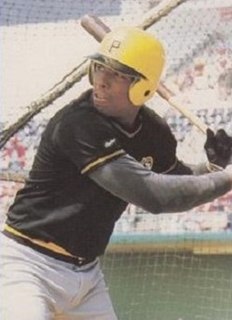

What's nice about investing is you don't have to swing at every pitch.

Related Quotes

Investing is the greatest business in the world because you never have to swing. You stand at the plate; the pitcher throws you General Motors at 47! U.S. Steel at 39! And nobody calls a strike on you. There's no penalty except opportunity. All day you wait for the pitch you like; then, when the fielders are asleep, you step up and hit it.

Value investing is simple to understand but difficult to implement. Value investors are not supersophisticated analytical wizards who create and apply intricate computer models to find attractive opportunities or assess underlying value. The hard part is discipline, patience, and judgment. Investors need discipline to avoid the many unattractive pitches that are thrown, patience to wait for the right pitch, and judgment to know when it is time to swing.

Some guys, first pitch of the at-bat gets called a strike - maybe it's a ball off or below their knees, and it gets called a strike - and then the next two pitches, they swing at balls in the dirt, and all of a sudden, they're yelling at the umpire about that first pitch. You just swung at two balls in the dirt, buddy.