A Quote by Warren Buffett

Great investment opportunities come around when excellent companies are surrounded by unusual circumstances that cause the stock to be misappraised.

Related Quotes

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.

There is no question that an important service is provided to investors by investment companies, investment advisors, trust departments, etc. This service revolves around the attainment of adequate diversification, the preservation of a long-term outlook, the ease of handling investment decisions and mechanics, and most importantly, the avoidance of the patently inferior investment techniques which seem to entice some individuals.

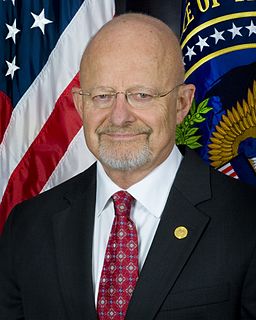

President Trump has the advantage of being surrounded by an excellent cadre of advisors. Kim Jong-un doesn't have any advisors that are going to give him objective counsel. He's surrounded by medal-bedecked sycophants, who dutifully follow him around like puppy dogs with their notebooks open, ascribing his every utterance, and pushing back against the great leader is not a way to get ahead.

I am proud of the fact that the U.K. is an open trading country. I welcome inward investment such as that of Nissan, and the takeover of struggling British companies by foreign companies who turn them around, as in the case of Jaguar Land Rover. I also accept that job losses sometimes have to occur to restore failing companies to health.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.