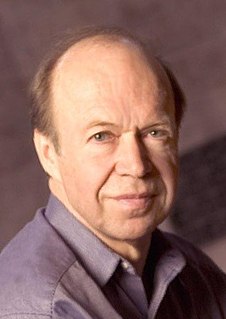

A Quote by Warren Buffett

If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value.

Related Quotes

To become a chess grandmaster also seems to take about ten years. (Only the legendary Bobby Fisher got to that elite level in less than that amount of time: it took him nine years.) And what's ten years? Well, it's roughly how long it takes to put in ten thousand hours of hard practice. Ten thousand hours is the magic number of greatness.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically. The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

Ten years dropped from a man's life are no small loss; ten years of manhood, of household happiness and care; ten years of honest labor, of conscious enjoyment of sunshine and outdoor beauty; ten years of grateful life--one day looking forward to all this; the next, waking to find them passed, and a blank.

And at a relatively early age, ten or so, I invested my first share of stock. And I used to follow, look at companies and so forth. But throughout the whole period, and indeed right through my college years, while I was involved in the stock market, always interested in finance, I never thought of it as a full-time job.

In going directly to Investment Heaven, you build your portfolio as you would build a wonderful company through a merger and acquisition program. You specify the way you want your portfolio to look, and then you assemble the profile piece by piece by bringing together companies that make their own individual contributions to the desired character.