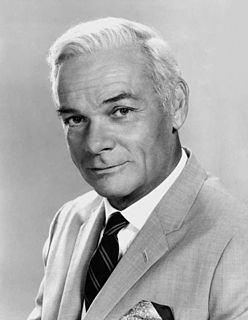

A Quote by Warren Buffett

As far as you are concerned, the stock market does not exist. Ignore it.

Related Quotes

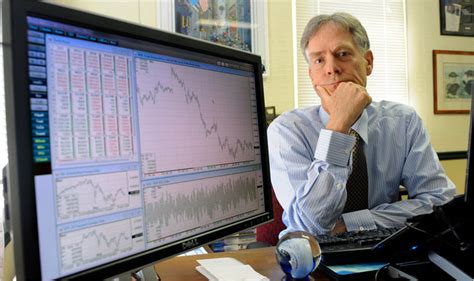

The correct attitude of the security analyst toward the stock market might well be that of a man toward his wife. He shouldn't pay too much attention to what the lady says, but he can't afford to ignore it entirely. That is pretty much the position that most of us find ourselves vis-à-vis the stock market.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

The correct method for tracking the stock market is to use semilogarithmic chart paper, since the market's history is sensibly related only on a percentage basis. The investor is concerned with percentage gain or loss, not the number of points traveled in a market average. Arithmetic scale is quite acceptable for tracking hourly waves. Channeling techniques work acceptably well on arithmetic scale with shorter term moves.