A Quote by Warren Buffett

It's got to be the best intellectual exercise out there. You're seeing through new situations every ten minutes. In the stock market you don't base your decisions on what the market is doing, but on what you think is rational. Bridge is about weighing gain/loss ratios. You're doing calculations all the time.

Related Quotes

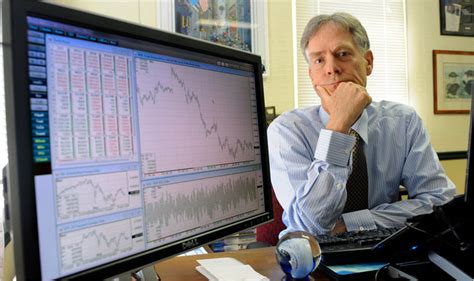

When I get hurt in the market, I get the hell out. It doesn't matter at all where the market is trading. I just get out, because I believe that once you're hurt in the market, your decisions are going to be far less objective than they are when you're doing well If you stick around when the market is severely against you, sooner or later they are going to carry you out.

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.

The correct method for tracking the stock market is to use semilogarithmic chart paper, since the market's history is sensibly related only on a percentage basis. The investor is concerned with percentage gain or loss, not the number of points traveled in a market average. Arithmetic scale is quite acceptable for tracking hourly waves. Channeling techniques work acceptably well on arithmetic scale with shorter term moves.

I am the largest market shareholder of clothing in the U.K. and I am not a destination shop for food. If the clothing market is affected - and it has been - and I hold my market share mathematically, then fine, I am doing no worse than the market is doing, which is exactly the case, but I'm losing revenue.

From the very first inkling of a concept, founders need to gather a target group of five to ten potential users to begin the feedback loop. We all think we know how the market will react to new ideas, but actual users live with the pros and cons of the existing market conditions every day. They are the market experts.

I am the largest market shareholder of clothing in the UK and I am not a destination shop for food. If the clothing market is affected - and it has been - and I hold my market share mathematically, then fine, I am doing no worse than the market is doing, which is exactly the case, but I'm losing revenue.

Don't think about what the market's going to do; you have absolutely no control over that. Think about what you're going to do if it gets there. In particular, you should spend no time at all thinking about those rosy scenarios in which the market goes your way, since in those situations, there's nothing more for you to do. Focus instead on those things you want least to happen and on what your response will be.