A Quote by Warren Buffett

It's easy to identify many investment managers with great recent records. But past results, though important, do not suffice when prospective performance is being judged. How the record has been achieved is crucial.

Related Quotes

The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.

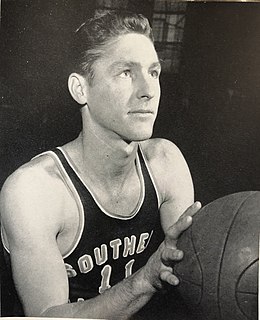

While I was coaching, I believe the motivation talk I gave my players that achieved the best results was in reference to their present game-day effort. I stressed the fact that today's performance could be the most important of their life. Yesterday's performance was already history. Tomorrow really never comes, so today's performance is what really counts.

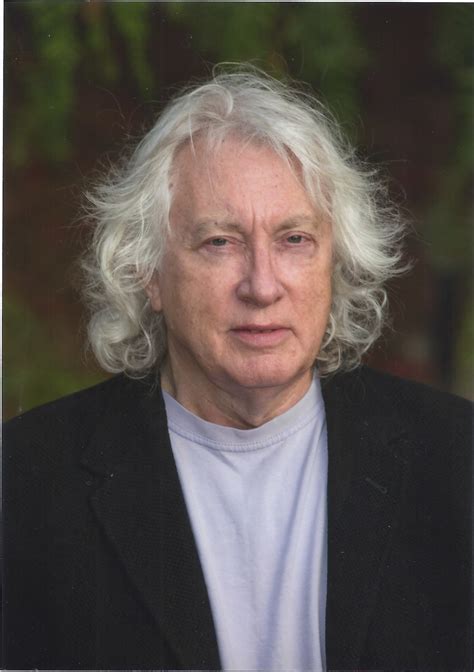

The debate can be put in the form of the question: Resolved, that the best of money managers cannot be demonstrated to be able to deliver the goods of superior portfolio-selection performance. Any jury that reviews the evidence, and there is a great deal of relevant evidence, must at least come out with the Scottish verdict: Superior investment performance is unproved.

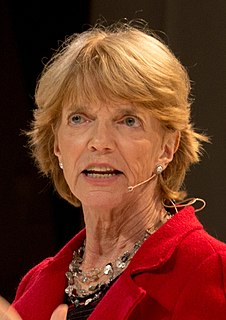

It's important to teach students about the reality of the system, that it is in fact the case that they are being targeted unfairly, that the rules have been set up in a way that authorize unfair treatment of them, and how difficult it is to challenge these laws in the courts. We need to teach them how our politics have changed in recent years, how there has been, in fact, a backlash. But we need to couple that information with stories of how people in the past have challenged these kinds of injustices, and the role that youth have played historically in those struggles.

America was my home for a very long time, and it's a fascinating, pioneering country that many people look to. In the recent past it hasn't been doing very well, but there's a great new hope now with the election of Obama. America took a very big leap there and proved that it still has the edge as far as being able to do things many other countries may find difficult.

One might think of investment managers as astronomers and CEOs as astronauts. The two roles are radically different with distinct personality traits. Like astronomers, investment managers tend to be introverted, skeptical, and very analytical. CEOs, like astronauts, are the exact opposite, typically being extroverts, optimists, and, well, leaders.