A Quote by Warren Buffett

First, many in Wall Street - a community in which quality control is not prized - will sell investors anything they will buy.

Related Quotes

A pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street (a community in which quality control is not prized) will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

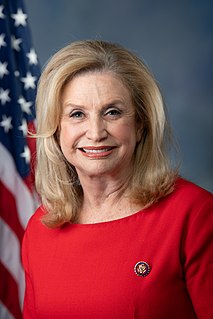

I write about one of my bills that says pharmacists cannot be doctors. They cannot determine what they will or will not sell, and you find that many pharmacists will not sell birth control. The movement has gone not just against the access of reproductive rights to abortion; the movement has gone to birth control. They're going after birth control.

Logic is the subject that has helped me most in picking stocks, if only because it taught me to identify the peculiar illogic of Wall Street. Actually Wall Street thinks just as the Greeks did. The early Greeks used to sit around for days and debate how many teeth a horse has. They thought they could figure it out just by sitting there, instead of checking the horse. A lot of investors sit around and debate whether a stock is going up, as if the financial muse will give them the answer, instead of checking the company.

Even in such a time of madness as the late twenties, a great many man in Wall Street remained quite sane. But they also remained very quiet. The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil. Perhaps this is inherent. In a community where the primary concern is making money, one of the necessary rules is to live and let live. To speak out against madness may be to ruin those who have succumbed to it. So the wise in Wall Street are nearly always silent. The foolish thus have the field to themselves. None rebukes them.