A Quote by Warren Buffett

If you were at Lehman, the same thing happened. If you were at AIG, the shareholders are getting creamed on these things. And those shareholders are not just a bunch of big shots in Wall Street. Those are pension funds, and those are investors all over the country. I wouldn't worry too much about that. Justice won't be perfect on it.

Related Quotes

Imagine if the pension funds and endowments that own much of the equity in our financial services companies demanded that those companies revisit the way mortgages were marketed to those without adequate skills to understand the products they were being sold. Management would have to change the way things were done.

You can look at what I did in the Senate. I did introduce legislation to rein in compensation. I looked at ways that the shareholders would have more control over what was going on in that arena. And specifically said to Wall Street, that what they were doing in the mortgage market was bringing our country down.

Shareholders are sort of like cats; they get herded around, and they follow the leader. With the exception of a few activist shareholders, there are a very rare number of big, important, influential shareholders that like to step up and say there's a problem here, especially when they're making money.

There is not a hint of one person who was afraid to draw near him [Jesus]. There were those who mocked him. There were those who were envious of him. There were those who misunderstood him. There were those who revered him. But there was not one person who considered him too holy, too divine, or too celestial to touch. There was not one person who was reluctant to approach him for fear of being rejected.

All those people who went out [to Occupy Wall Street] missed work, didn't get paid. Those were individuals who were already feeling the effects of inequality, so they didn't have a lot to lose. And then the individuals who were louder, more disruptive and, in many ways, more effective at drawing attention to their concerns were immediately castigated by authorities. They were cordoned off, pepper-sprayed, thrown in jail.

The fund scandals shined the spotlight on the fact that mutual fund managers were putting their interests ahead of the fund shareholders who trusted them, which had much more substantial consequences in the form of excessive fees and the promotion - as the market moved into the stratosphere - of technology funds and new economy funds which were soon to collapse.

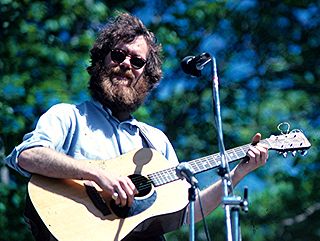

You just do the best you can. It doesn't necessarily mean that you have to get worse the more you do it. It can get better, I think... aspects of it, anyway. I mean, I don't write as much as I used to. But I don't do a lot of things as much as I used to. So that's the natural order of things, too. You're more or less living in the present. You're just trying to get that next song, whatever it is. And not think too much about what happened on the last record, or the record you made 20 years ago, because those are over with. Those are done.

The problems that exist on Wall Street today go to the center of a debate in this country about wealth and democracy. We cannot keep our democracy if those who are in charge of handling the engines of our economy are not honest with their shareholders. That's why there is a role for government regulation here. That role for government is breaking up the monopolies, insisting on public disclosure, insisting on public audits, insisting on restitution whenever someone has been cheated.

I believe Washington should be a more active participant focusing on the issue of why corporate shareholders and mutual fund shareholders are not given fair treatment by corporate management and mutual fund management. We need to develop a national standard of fiduciary duty to ensure that these agents, if you will, are adequately representing the principles - pension beneficiaries and mutual fund shareholders - whom they are duty bound to serve.